Shop

Show Filters

Showing 1–12 of 85 results

Hoverboards for sale from SWAGTRON. Choose from our quality selection of Bluetooth hoverboards, kids hoverboards, adult hoverboards, off-road hoverboards, and cheap hoverboards for sale. SWAGTRON hoverboards are UL 2272 Certified for hoverboard safety, come with free shipping and a 30-day money-back guarantee.

Everything we do at Swagtron is about mobility. We are innovators and market leaders as the #1 brand of electric-rideables. From Hoverboards to e-bikes, skateboards, scooters, and more we are committed to making every experience with our products fun and accessible for all.

One of Swagtrons competitive advantages is its vertically integrated business model, covering the entire value chain: design, product development, manufacturing, logistics, sales, marketing, and distribution.

Showing 1–12 of 85 results

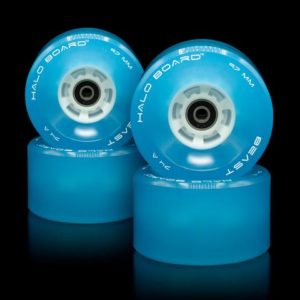

H1 is powered by two 200W motors that enable it to climb 15 degree inclines and reach a 9 mph top speed. The 6.5″ solid wheels provide a smooth and enjoyable ride.

H1 is powered by two 200W motors that enable it to climb 15 degree inclines and reach a 9 mph top speed. The 6.5″ solid wheels provide a smooth and enjoyable ride.