Contents:

This means that the forex broker is required to keep client money protected in segregated bank accounts and keep crime away from the platform via KYC processes. On the other side of the scale, a ‘Golden Cross’ would occur if the 50-day moving average crosses from below the 200-day moving average to above. This would indicate that the forex pair is about to enter a bullish market.

Once you’ve mastered those markets, you can consider expanding your portfolio. This strategy will first require you to select a maximum stake percentage. The general rule of thumb for most forex day traders is 1% in this respect. This means that irrespective of how successful you are – you will never risk more than 1% of your trading capital. Irrespective of whether you are a complete novice or a seasoned forex trader – demo accounts are one of the best tools you can have by your side.

how to day trade forex traders use any of a number of strategies, including swing trading, arbitrage, and trading news. They refine these strategies until they produce consistent profits and limit their losses. But there are day traders who make a successful living despite—or perhaps because of—the risks. Day traders execute short and long trades to capitalize on intraday market price action, which result from temporary supply and demand inefficiencies. When it comes to averaging down, traders must not add to positions but rather sell losers quickly with a pre-planned exit strategy.

Even when a market is trending, there are bound to be small price fluctuations that go against the prevailing trend direction. For this reason, trend trading favors a long-term approach known as position trading. For obvious reasons, trend traders favor trending markets or those that swing between overbought and oversold thresholds with relative predictability. Unlike scalpers, who are looking to stay in markets for a few minutes, day traders usually stay active over the day monitoring and managing opened trades. Day traders are mostly using 30-min and 1-hour time frames to generate trading ideas. However, it requires a lot of time to devote to the markets – although many day traders use mobile apps, stops, take profits, and more to avoid sitting at a computer for hours each session.

Trade forex online with Axi

For example, there are liquidity providers, banks, and software providers. Finally, there are traders who provide the capital and do the real trading. In the previous part, we have looked at what forex trading is.

Margin – Margin is the amount of money that you need to maintain your leverage. A margin call is when the broker asks you to increase your cash to avoid the trade being ended. Second, these companies work with other players behind the scenes.

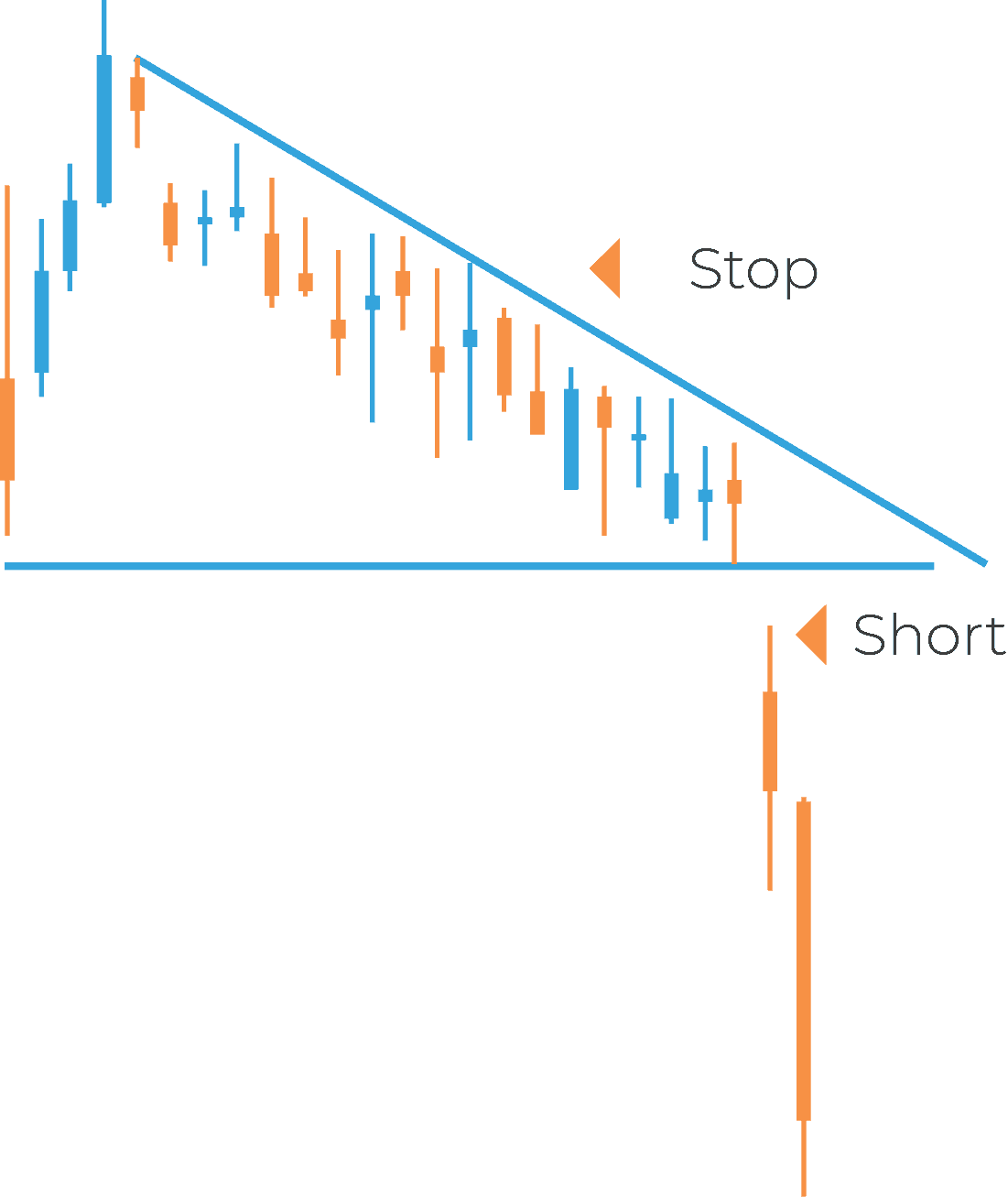

A stop loss order is a point at which a position is automatically closed out if the price of the security drops below the trader’s entry point. Countertrend trading favors those who know recent price action really well and so know when to bet against it. This strategy is fighting the trend and can work against traders at times. Since our thinking is a “counter trend”, we would look for trades in the opposite direction of the overall trend on a smaller timeframe such as a 15-minute chart. Using indicators on the shorter time frame chart will give you an idea of when to time your entries.

What is a Lot Size, Formula and How to Calculate a Lot in Forex

It’s possible that day traders may look to execute multiple trades on the same asset on the same day. The key for day traders is to find beneficial entry and exit points in the markets that enable them to take small, regular profits from often tiny market movements. It’s a trading concept – making small, but multiple profits on modest price moves throughout a day.

Start out with a couple of currencies Even if you aren’t planning on trading the news, it pays to know your chosen FX pairs inside-out when you’re day trading forex. After all, outside influences can derail even the best-planned technical strategy. The best time to day trade forex is typically when the market is at its most liquid. Day traders tend to require a lot of liquidity, so they can enter and exit positions quickly and cheaply. We are now going to show you how to can start day trading forex from the comfort of your home with the best currency broker and the best day trading platform of 2021 – eToro.

Some things to consider if you decide to day trade:

However, you should be aware that there are scams operating in the forex market as there is no central regulator. FX trading can be profitable depending on your strategy and trading skills. But it also carries high risk of losses as unexpected events and excess leverage can quickly deplete capital. Open your first trade and consider using risk management tools such as a stop loss. While futures contracts and CFDs both allow traders to speculate on the direction of an asset price, there are differences in how they work in practice. FX rates fluctuate constantly throughout the day, based on whether one currency is in higher demand than the other.

How Can Someone With A Day Job Ever Become A Day Trader? – Barchart

How Can Someone With A Day Job Ever Become A Day Trader?.

Posted: Mon, 27 Mar 2023 14:33:39 GMT [source]

Position traders are likely to start selling the dollar on trillion-dollar stimulus packages. For example, if your account is worth $30,000, you should risk up to $300 on a single trade if the risk limit is set at 1%. Depending on your risk sentiment, you can move this limit to 0.5% or 2%.

At times, you will find it more profitable to exit with a small profit and then find opportunities elsewhere. As such, it is recommended that you combine different types of indicators. The pair then declined sharply after getting to the overbought level.

Many professional https://g-markets.net/ managers and financial advisors shy away from day trading. They argue that, in most cases, the reward does not justify the risk. But it can be challenging for novices—especially those who don’t have a well-planned strategy. And be aware that even the most seasoned day traders can hit rough patches and experience losses. Intraday, a trader must also accept what the market provides at its various intervals.

Day trading works by buying a stock or opening a position at a point in the day, then selling the stock or closing the position later that same day before the market closes. Day traders aim to make money from these trades, buying low and selling high, or predicting the short-term movements of stocks. As such, day trading is very much a behaviour based entirely on price volatility. As a forex trader, you will get to know the foreign exchange market very well. The FX market is the world’s largest financial market by a significant margin and operates as a decentralized global market for currency trading. Instead of a central exchange, financial centers, such as New York and Hong Kong, act as hubs for forex trades.

We always try to be cautious when embarking on a new financial project. So before jumping into the market we should work out a plan, try out some demo accounts, research brokers, and finally, start trading. This is a trading strategy where you buy a currency pair and hold it for a few days. Swing traders typically use longer charts like hourly and four-hour.

Many FX traders have strict rules over how much of their capital to commit to any single trade, too – say, only committing 1% or 2% of their balance at any time. Capital.com is one of the best forex day trading platforms for those with little to no experience in this industry. Much like eToro, the online trading platform offered by the broker is simple and seamless to use.

Day trading is one of the most popular trading styles, especially in the US. Here are some of the things that you need to know about day trading on forex and other markets, and how you can get started. A day trader who is using this strategy and is looking to go long will buy around the low price and sell at the high price. For example, if the price has been rising off a support level or falling off a resistance level, then a trader might choose to buy or sell based on their perception of the market’s direction.

- https://g-markets.net/wp-content/uploads/2021/09/image-wZzqkX7g2OcQRKJU.jpeg

- https://g-markets.net/wp-content/uploads/2021/04/Joe-Rieth.jpg

- https://g-markets.net/wp-content/uploads/2020/09/g-favicon.png

- https://g-markets.net/wp-content/uploads/2021/09/image-Le61UcsVFpXaSECm.jpeg

Margin trading requires a smaller investment, which gives traders leverage to more substantial trading volumes. The risks are greater as well, however, as the trader could end up losing more than their deposit if prices move in the opposite direction. Forex day trading is a short-term trading strategy that focuses on the buying and selling of currency pairs within the same trading day. Typically, traders will place a number of forex trades per day, and close them out at the end of the trading day, rather than holding overnight positions.

- Original price was: $999.99.$899.99Current price is: $899.99. Check Availability